Proportional Tax System Pros and Cons

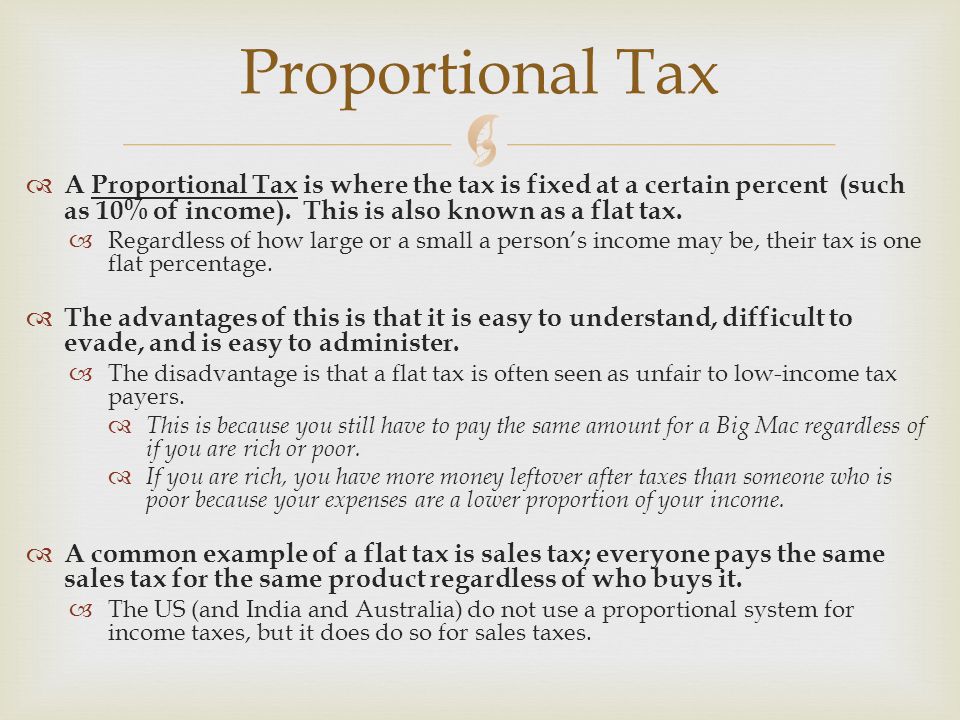

The proportional tax has its own pros and cons. The proportional tax imposes the same percentage on everyone.

Macroeconomic Regulation Ppt Download

List of Pros of Flat Tax.

. It encourages them to work harder earn more so that they will have more money to spend for all of their needs. Proportional representation is a system of political representation that has been growing by leaps and bounds. Someone earning 50k per year would pay 10 taxes on the first 25k they earned but then 15 on the.

Toward a Concept of Income Fairness When the United States government first implemented a system of taxation economists soon observed a uniform tax rate would fall. 8 Progressive Tax System Pros and Cons. The reason behind this argument is that the tax rule does not exempt anyone but instead it cuts across all income earners.

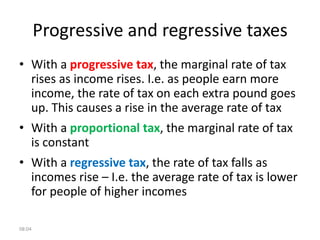

A proportional system is one in which everyone pays the same percentage in taxes. It creates incentives to reduce taxable income. Percentages increase as income rises.

A proportional tax is a kind of income tax wherein all taxpayers are taxed at the same percentage rate no matter how high or low their income. That structure makes it easier for extremist views to find official representation. PR gives room for minority parties to be represented as compared to other electoral systems where the majority wins.

Answer 1 of 2. One of the proportional tax cons is inequality. There is also a belief that a proportional tax system is a way of motivating people to.

In essence this type of taxation can motivate taxpayers to earn more or produce more as they will not incur additional taxes the. In a regressive system all consumers pay the same dollar amount. With the progressive system they have to pay different tax rates based on how much they make.

Lets look at the pros and cons of using this electoral system. The system of brackets that is used in the United States creates a tax system which incentivizes certain purchases or economic activities. In a progressive system such as the United States federal tax code the percentage of taxation increases as income levels increase.

Someone making 25k per year for example may have a 10 tax rate on this income. Proportional Taxes remain constant even with the fluctuations of income making it beneficial for high income earners. Leads to weaker relationship between voters and representatives.

List of the Cons of Proportional Representation. Flat Tax System. Here are the pros and cons of flat tax.

Allow the government to spend money on basic operations. Proportional taxes can be defined as progressive taxes not because they have anything to do with being progressive or liberal but because the rates go up as the taxable income goes up. Pros of the Progressive Tax System.

In the US this is implemented as a progressive tax system which means that high-income earners would pay taxes at higher rates than low-income earners. It will eliminate other taxes. With the flat rate system both will pay the exact same amount.

By reducing taxable income levels incentives are created to avoid paying taxes within the bracket of the actual income earned. More likely to encourage nomination of more diverse range of candidates more women and people from minority groups are elected under proportional voting. A proportional tax system allocates a higher amount of tax burden on those who earn a lower income than those who earn a higher income.

Pros and Cons of Proportional Taxes. The closest comparative system would be the representative republic such as used in the United States. Lets say that Person 1 earns 5000 and Person 2 makes 500000.

It is widely used in Europe and has both advantages and disadvantages. Pros and Cons of Proportional Taxes Proportional taxes are a type of regressive tax because the tax rate does not increase as the amount of income subject to taxation rises placing a higher. Proportional Representations Pros and Cons.

What pros and cons does this type of tax structure offer today. A proportional tax system means that everyone experiences the same tax rate whether low middle or high-income. Up to 24 cash back Eliminates vote wastage prevents gerrymandering and may reduce malapportionment.

The advantage of proportional tax is that taxpayers are exposed to the same tax rate or percentage regardless of their earning or tax bracket. It often eliminates deductions and credits. Wealthier taxpayers pay higher rates.

In general systems of taxation are proportional progressive or regressive in nature. This system has benefits of providing tax leeway for people that have very low income. A proportional tax is quite different than a progressive tax system which involves different tax rates.

A good tax system should be fair to everyone transparency adequacy simplicity and administrative ease. Therefore it creates a downward burden on the amount of local earnings families can save. While there are many advocates for this system there are also those that oppose such.

The same percentage applies to all income levels. Also it should be noted that Person 2 is paying much bigger tax because they have a greater income. However tax rates increase as incomes rise thus creating a disincentive effect on people to pursue higher incomes.

It ensures all the interests and views of the public are represented in the government. Everyone pays the same rate. Equity of tax rates is a major concern for this system and the rich seem to be covering for the poors.

List of the Cons of Progressive Tax. In a progressive system of taxation there is a greater portion of personal income that gets taxed at certain income levels. Income Equality - This is one of the biggest pros that progressive tax advocates promote.

Flat taxes stay at the same percentage regardless of the income level. The first and foremost advantage of proportional tax is that since all people pay taxes at the same rate there is no ambiguity as to rate of taxation which in itself lead to clarity in the minds of taxpayers as well as tax collecting authorities because when it comes to taxes majority of people do not understand the tax rates as there are many slabs and exemption. Pros - Supporters of the proportional tax argue that this taxation system ensures fairness.

Spending is rewarded through deductions. It makes things easier for extreme parties to gain representation. Under the system of proportional representation any party with a high enough percentage of the vote will receive a seat in the government.

Of the three most countries use the progressive tax system. The tax can either be a proportional progressive or regressive tax.

Expired Script Tom Ferry Real Estate Advice Real Estate Memes Real Estate Tips

Proportional Tax Definition Business Example Pros Cons Explained

Advantages And Disadvantages Of A Proportional Income Tax Download Scientific Diagram

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Pros Cons Regressive Proportional Tax System Ppt Powerpoint Presentation Inspiration Cpb Template Presentation Sample Of Ppt Presentation Presentation Background Images

Advantages And Disadvantages Of A Proportional Income Tax Download Scientific Diagram

Proportional Tax Definition Examples Video Lesson Transcript Study Com

Proportional Tax Intelligent Economist

Proportional Tax Definition Examples Video Lesson Transcript Study Com

Progressive And Regressive Taxes

Advantages And Disadvantages Of A Proportional Income Tax Download Scientific Diagram

Economics Lesson Aggregate Demand Apc Aps By Outstanding Resources Economics Edu Econs Parents Aggregate Demand Economics Lessons Learning Objectives

Pros Cons Regressive Proportional Tax System Ppt Powerpoint Presentation Inspiration Cpb Template Presentation Sample Of Ppt Presentation Presentation Background Images

As A Boss The Question To Ask Is How Powerful Are My Employees Employee Empowerment Grow Business

Advantages And Disadvantages Of A Proportional Income Tax Download Scientific Diagram

Advantages And Disadvantages Of A Proportional Income Tax Download Scientific Diagram

/GettyImages-649719504-62b7bc84aa6c47a7ba6c985cd65a8e4e.jpg)

Comments

Post a Comment